Advisor Relationships

While other digital investing solutions, or robo advisors, offer online investment management, many don’t include a direct personal relationship with a financial advisor, unless you’re willing to invest substantial amounts.

Personal advisor

With GWP, no matter how large or small your investment amount, you get a personal advisor, dedicated to you and your goals. All you need to get started is $5,000* to invest. Whatever your investment goals, we can help you.

Investment Management

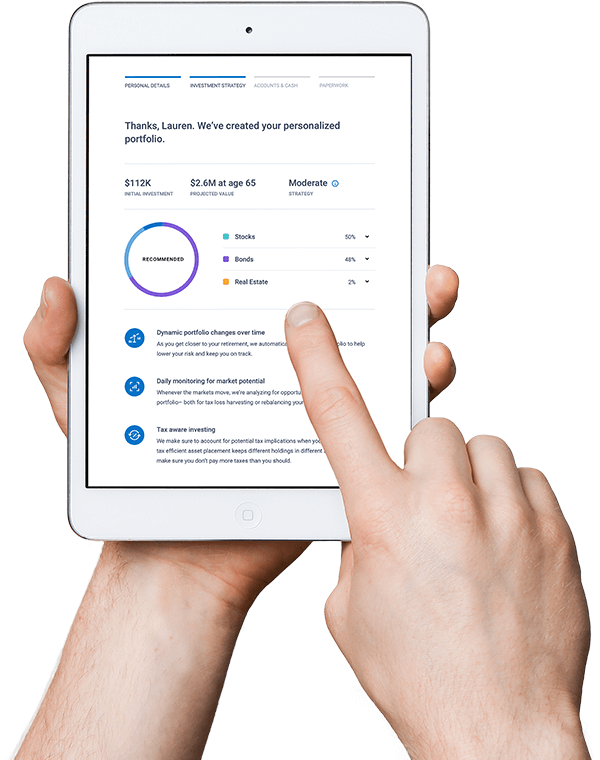

Guided Wealth Portfolios offers investment management designed to help you pursue your financial objectives. You’ll receive diversified allocations designed for you and your savings goals, and benefit from trading techniques.

Smart Investing Strategy

By investing with us, you’ll enjoy services such as tax-efficient investing, consistent monitoring, tax-loss harvest, financial advice, and more!

Tax-Efficient Investing

Through advanced asset analysis, we’ll allocate your assets in a tax-efficient manner and evaluate the tax impact of each trade before it goes through.

Consistent Monitoring

Your portfolio is monitored daily, keeping it on track as markets move and rebalancing it as needed.

Tax-Loss Harvesting

If an investment experiences a loss, we may sell it to offset taxable gains in your portfolio. The investments sold are replaced by similar investments to maintain your asset allocation, so you get tax benefits while keeping a properly diversified portfolio.

Financial Advice

We’re available any time you have a question about your account or investing strategy.

Advisor + Technology

Who does what?

GWP has three major players who all work together to build and deliver your customized portfolio.

The Portfolio Designer

LPL Research, an experienced money manager that manages more than $160 billion for clients, chooses the investments for the portfolio models.**

Your Advisor

Your advisor reviews your suggested portfolio allocation to make sure it’s right for you. As your goals or life change, your advisor is available to help you determine if your GWP portfolio will continue to be the right solution for you.

The Technology

Sophisticated algorithms are built into the technology. They examine your portfolio every day to see if it can be optimized. These algorithms can trigger rebalancing or tax-loss harvesting to ensure your portfolio stays in line with your goals and to create opportunities to help you save on taxes.

Guided Wealth Portfolios

Investment Process & Philosophy

With Guided Wealth Portfolios (GWP), we aim to provide you a diversified portfolio that matches your risk preferences and helps you work toward your unique financial goals.

This is combined with daily account monitoring that auto-rebalances your account when necessary and identifies tax-saving opportunities to not only keep your portfolio in line with its goals, but potentially improve it for greater diversification and future growth. With GWP, you don’t have to worry about managing or updating your portfolio, as we handle it for you. You get insight into what’s happening in your portfolio through your online portal, and if you ever have any questions about your investment strategy, we’re just a phone call away.

What you'll get today

Frequently Asked Questions

Strategy

LPL Financial has collaborated with FutureAdvisor to provide you with an advisor-enhanced digital wealth management experience: Guided Wealth Portfolios. The investment platform takes academically researched portfolio management principles and industry best practices and implements them as a holistic approach to help you pursue your financial goals. In most cases, the service replaces your existing holdings with ETFs to diversify your portfolio. You can read more details about the service’s methodology below.

Guided Wealth Portfolios investment management philosophy is based on the belief that diversified investing is the best approach for providing consistent results over time. It combines this investment philosophy with daily, algorithmic monitoring that auto-rebalances your accounts, identifies tax-saving opportunities, and manages your household accounts.

Since Guided Wealth Portfolios investment management can manage multiple accounts together, it can place your investments tax-efficiently and choose an appropriate allocation for your situation. Everything we do is personalized based on the details you share, including your risk tolerance, age, years to goal (if applicable), and the needs you express when completing our questionnaire. This is what makes Guided Wealth Portfolios a compelling investment management service.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The exchange traded funds (ETFs) recommended in Guided Wealth Portfolios are passive investment securities that replicate the performance of an index representing a certain asset class. ETFs trade on an exchange and are bought and sold like stocks. ETFs usually have a lower expense ratio than actively managed mutual funds. The ETFs that Guided Wealth Portfolios invests in are large, liquid investments that track the benchmark that LPL Research has identified as being appropriate for the portfolio.

An investment in Exchange Traded Product (ETPs) involves risks such as: market, non diversification, price volatility, liquidity, competitive industry pressure, international political and economic developments, possible trading halts, index tracking error.

How It Works : Signing Up

Guided Wealth Portfolios investment management is powered by FutureAdvisor, based on model portfolios created by LPL, and provides you the opportunity to begin a relationship with a financial advisor. LPL is a leading independent broker/dealer, offering an integrated platform of proprietary technology, brokerage, and investment advisory services to more than 16,000 financial advisors and approximately 700 financial institutions. Both LPL and FutureAdvisor are investment advisors registered with the U.S. Securities and Exchange Commission. FutureAdvisor, wholly owned by BlackRock, Inc., is comprised of a team of financial professionals, data scientists, and software engineers. For more information on your financial advisor, please contact him or her.

To sign up for Guided Wealth Portfolios investment management, you must:

- Be a U.S. resident and U.S. citizen

- Be at least 18 years old

- Have at least five years to retirement and be no more than 68 years old (if selecting retirement as goal)

- Have at least $5,000 in investable assets

- Have a valid Social Security number or Tax Identification Number

Eligible Guided Wealth Portfolios accounts include Individual Retirement Account types such as traditional IRA, Roth IRA, and IRA Rollovers, plus individual and joint taxable accounts.

Yes, we can help open traditional IRA, Roth IRA, and individual or joint taxable accounts for you. Simply let us know and we’ll help you get started.

Guided Wealth Portfolios will manage multiple accounts collectively towards one goal. Householding enables us to use tax-efficient asset placement and tax-loss harvesting strategies across accounts. You may household different accounts for different goals, but each account can be used for only one goal.

- Householding Definition Your “household” consists of eligible accounts, defined above, held with a single LPL Financial advisor and owned by you and, if applicable, your spouse or spousal equivalent (“partner”) and managed towards one goal.

- One Client Profile. All accounts must share one client profile. For households with partners, that means you and your partner must have the same goal, the same risk tolerance and the same number of years to invest for the goal (for retirement and major purchase goals). You should consult your LPL Financial Advisor for assistance in determining whether householding is appropriate for you and your partner.

- Pros and Cons of Householding

You should evaluate the pros and cons of householding to determine whether it is right for you.- One Risk Tolerance and Investment Horizon. Householding requires the election of one goal, one risk tolerance and one investment time horizon (determined by years to goal for retirement and major purchase goals) per household per goal. If you and your partner do not share the same goal, risk tolerance and/or years to goal (for retirement and major purchase goals), householding is not appropriate for you.

- Asymmetrical Asset Placement. Householding is based on a single Investment Objective, taking into account all of your household’s account types to determine where certain asset classes will be placed. For example, you and your partner have two accounts. Your account is a tax-deferred account (e.g., Traditional IRA) and your partner’s account is a taxable account. We may place income-producing assets like high-dividend-paying ETFs (i.e., fixed income ETFs) in the tax-deferred account in order to shield the assets’ dividend income from taxes as it grows. This may result in the placement of equity ETFs with higher growth potential and potential risk concentrated into your partner’s taxable accounts. Although the taxable and non-taxable accounts may be concentrated with specific asset classes, the accounts are being managed collectively towards one goal and one investment objective.

- Privacy. For households with partners, as part of the householding process, one partner is identified as the primary partner. The primary partner is issued a username and password to view and access the householded Guided Wealth Portfolios accounts through our site. Additionally, the primary partner’s email address will be used by Guided Wealth Portfolios to communicate with all members of the household. The secondary partner is not provided with a separate username and password. Householding requires the secondary partner to share personal information with the primary contact/accountholder in the household and to rely upon the primary contact/accountholder to share information and correspondence relating to the householded accounts. Householding will also result in certain notices and other important information being provided only once to the household. If you would like to keep your logins, passwords, and assets private from your partner, householding may not be for you.

- Termination of Householding Relationship. For households with partners, in the event of a separation, dissolution, or just the desire to terminate the householding relationship, the partner that separates from the existing GWP relationship will need to re-enroll in GWP in order to continue management of his or her accounts. Please note that the returns of one partner prior to such termination may be materially different from those of the other partner, as the assets were intended to grow toward one collective goal. Additionally, trading activity may be necessary (for both the remaining partner and newly enrolling partner) in order to rebalance accounts after termination of the householding relationship.

- Pros and Cons of Householding

- Do I have to sell or liquidate my existing investments in order to sign up for Guided Wealth Portfolios investment management, or will the GWP team take care of it for me?

No, you do not have to sell or liquidate your existing investments yourself. The Guided Wealth Portfolios team will work with you to complete the necessary paperwork to consolidate your accounts at LPL Financial. Although Guided Wealth Portfolios can accept transfers of your existing investments, there will be instances where certain securities will require liquidation prior to transferring to Guided Wealth Portfolios. Securities which you use to fund your account generally will be sold in order to properly diversify your portfolio in accordance with our investment models. Securities will be sold in a tax-conscious manner in taxable accounts. We’ll work with you through this process as necessary. - Why do I have to transfer my assets to LPL Financial to enroll in Guided Wealth Portfolios investment management?

Transferring your assets to LPL Financial enables us to execute trades in your accounts and keep your portfolio optimally balanced to help you pursue your investment goals. LPL Financial will assume custody of your accounts. LPL Financial is a Member of SIPC. Membership provides account protection up to a maximum of $500,000, of which $250,000 may be claims for cash. The account protection applies when an SIPC member firm fails financially and is unable to meet obligations to securities clients, but it does not protect against losses from the rise and fall in the market value of investments. For details, please see www.sipc.org. for an explanatory brochure. LPL utilizes a lineup of low-fee and commission-free ETFs to balance your portfolio. - How do I transfer my assets when signing up for Guided Wealth Portfolios investment management? We can transfer individual accounts with over $5,000 consisting of mutual funds, ETFs, and equities as-is, which enables us to conduct a detailed analysis of the tax-lot information in your accounts for each holding before considering a sale. See the “Taxes” section below for more information about how we strive to minimize tax impact during trading.

No. You should not transfer in securities if you do not want to have them liquidated. Some positions may be temporarily held generally with the goal of optimizing tax impacts (for accounts that are subject to tax), but most positions will be immediately sold and replaced with the ETFs used in the GWP model portfolios.

How It Works : Day-to-Day

Investing and portfolio monitoring is done by Guided Wealth Portfolios using an algorithm-driven recommendations engine.

Following the initial rebalance, we monitor your portfolio(s) daily and rebalance when your assets drift outside of our target allocation, or when life events alter your investment profile, risk tolerance, or investment horizon. Depending upon the size of the account, on average, we expect to rebalance portfolios four to six times per year.

No. Your individual investments are determined by your answers to the investment profile questionnaire and your number of years to goal (in the case of retirement or major purchase goals). For general investing, your individual investments are determined by your answers to the investment profile questionnaire. You’ll have some ability to change your profile in the online dashboard, which may affect the individual investments in your portfolio, but you won’t be able to make specific trading decisions within your account. If you have any questions, please reach out to your dedicated advisor.

When your Guided Wealth Portfolios account is active, you can view your portfolio any time by logging into your account and visiting your dashboard. You’ll also have access to your account statements and tax documents through the LPL Financial Account View portal, accessible from a link on the ‘My Accounts’ page of your dashboard. If you have additional questions, please contact team@lplguidedwealth.com.

- Login to managed dashboard

- On home page, click on ‘start new goal’

- Select goal

- Follow enrollment process depending on new goal – indicate years to goal and answer RTQ

- Click ‘fund this goal’

- Click transfer investment account

- Report current GWP account information

- Complete enrollment process

Please reach out to team@lplguidedwealth.com for this type of request. Once the funds have been deposited, they’ll be automatically invested within five business days (although we wait until you have approximately $250 or more in cash per account before we invest).

- After logging in, click ‘Deposit cash’

- Select New Investment Account

- Select Investment account to deposit money to

- Fill the amount of cash to invest

- Fill the frequency

- Fill the day of month

- Select an existing bank account or fill information for a new bank account:

- Bank account to transfer money from

- Bank account type

- Bank account owner (if applicable)

- Bank account routing number

- Bank account number

- Click ‘Review deposit’

- Once you confirm the details, click ‘Start paperwork’

Please reach out to team@lplguidedwealth.com for this type of request.

We will invest in low-fee ETF index funds within your portfolio to address your specific diversification goals. Below are the ETFs used in our model portfolios, although your portfolio may vary due to investments you transferred over when opening your account:

As of 01/2019

| Asset Class | Ticker | Fund Name | Expense Ratio |

|---|---|---|---|

| Equities | |||

| Domestic Large Cap Growth | IUSG | iShares Core S&P US Growth ETF | 0.04% |

| Domestic Large Cap Value | IUSV | iShares Core S&P U.S. Value ETF | 0.04% |

| Domestic Mid Cap | VO | Vanguard Mid-Cap Index Fund ETF | 0.05% |

| Domestic Small Cap | VB | Vanguard Small-Cap Index Fund ETF | 0.05% |

| Developed Total | IEFA | iShares Core MSCI EAFE ETF | 0.08% |

| Emerging Total | IEMG | iShares Core MSCI Emerging Markets ETF | 0.14% |

| Fixed Income | |||

| Investment Grade Bonds | BND | Vanguard Total Bond Index ETF | 0.05% |

| Corporate Investment Grade Bonds | VCIT | Vanguard Intermediate-Term Corp Bond ETF | 0.07% |

| TIPS | TIP | iShares TIPS Bond ETF | 0.20% |

| High Yield Bonds | JNK | SPDR Barclays High Yield Bond ETF | 0.40% |

* This is a hypothetical example of a GWP account allocation. Any discussion of specific securities is intended to help clients understand our investment management style and should not be regarded as a recommendation of any security for any person. Your financial advisor can provide you with information regarding the special risks associated with the underlying ETFs used in Guided Wealth Portfolios.

You can sign in to your Guided Wealth Portfolios dashboard at any time to get a comprehensive view of your portfolio’s past performance under Guided Wealth Portfolios investment management, a timeline of most recent actions we have taken to potentially improve your portfolio, and account-by-account portfolio holdings.

You’ll have access to your account statements and tax documents through the LPL Financial Account View portal, accessible from a link on the ‘My Accounts’ page of your dashboard. If you have additional questions, please contact team@lplguidedwealth.com.

Taxes

The Guided Wealth Portfolios tax optimization strategy is designed to consider the potential tax impact of selling a security held in your portfolio. When your portfolio is rebalanced, the service considers capital gains and tax implications to minimize the tax impact to your portfolio.

In most cases, our portfolio rebalancing algorithm is designed to limit realized short term capital gains to the greater of $200 or 5% of the position value. Exceptions may be made in certain circumstances, including liquidating a position to avoid fund fees or future transaction costs, and in order to meet cash targets such as strategic cash allocations or client instructions to hold or increase cash.. With respect to long-term gains, the service will balance a variety of factors to determine optimal treatment, considering your years to goal, portfolio size, and the potential diversification impact of a given set of transactions. Rebalancing a portfolio may cause investors to incur tax liabilities. References to tax strategies that Guided Wealth Portfolios investment management considers in managing accounts should not be confused with tax advice. LPL Financial does not provide tax advice. Clients should consult with their personal tax advisors regarding the tax consequences of investing.

FutureAdvisor monitors each of your taxable account holdings daily, looking for positions with at least $500 and 1.5% in harvestable, taxable losses given the current market prices of the ETFs. To harvest taxable losses, we sell the tax lots with unrealized losses and purchase a preselected similar index fund within the same asset class. In this way, we bank the losses for tax purposes without changing the overall portfolio asset allocation. At the end of the year, we’re able to use these taxable losses to offset your gains for the year and/or ordinary income.

References to tax strategies that Guided Wealth Portfolios investment management considers in managing accounts should not be confused with tax advice. LPL Financial does not provide tax advice. You should consult with your tax advisors regarding your individual situation.

References to tax strategies that Guided Wealth Portfolios investment management considers in managing accounts should not be confused with tax advice. LPL Financial does not provide tax advice. You should consult with your tax advisors regarding your individual situation.

An Internal Revenue Service (IRS) rule prohibits a taxpayer from claiming a loss on the sale or trade of a security in a wash sale. A wash sale occurs when an individual sells or trades a security at a loss, and within 30 days before or after this sale, buys a “substantially identical” stock or security. A wash sale also results if an individual sells a security and their spouse buys a substantially equivalent security. Investors generally can avoid incurring wash sales and benefit from capital losses by selling securities that they are losing money on and buying others that have very similar characteristics. We have internal guidelines and policies designed to prevent wash sales in individual and householded Guided Wealth Portfolios accounts. However, we’re unable to factor in trades for other GWP accounts not held within a household. We help you benefit from capital losses through our tax-loss harvesting.

Fees

Your financial advisor has established what he or she believes to be an appropriate management fee, which you’re charged based on your assets under management (including cash holdings). There is also a program fee of 0.35% of assets under management, which is paid to LPL The management and program fees are billed in quarterly installments and deducted from each of your eligible accounts. Certain other fees may apply pursuant to the terms of your Account Agreement, including but not limited to, underlying fund expense ratios and a quarterly small account fee for each account under $10,000.

You won’t be charged trading commissions within your Guided Wealth Portfolios accounts.

It depends on which brokerage firm you used prior to signing up for Guided Wealth Portfolios investment management. Most brokerage firms and mutual fund companies charge fees ranging from $50 to $150 per account to transfer. Please check with your current brokerage for details.

You won’t be charged an account opening fee. Any individual managed account with less than $10,000 will be charged a $5 small account fee on a quarterly basis. This fee will come directly out of your account. Accounts may also be subject to other fees.

About GWP

Guided Wealth Portfolios (GWP) is a centrally managed, algorithm-based, investment program sponsored by LPL Financial LLC (LPL). GWP uses proprietary, automated, computer algorithms of FutureAdvisor to generate investment recommendations based upon model portfolios constructed by LPL.

FutureAdvisor and LPL are nonaffiliated entities. If you are receiving advisory services in GWP from a separately registered investment advisor firm other than LPL or FutureAdvisor, LPL and FutureAdvisor are not affiliates of such advisor.

Both LPL and FutureAdvisor are investment advisors registered with the U.S. Securities and Exchange Commission, and LPL is also a Member FINRA/SIPC.

All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. With your free dynamic proposal, you will have access to sample recommendations at no charge to you. If you decide to open a GWP investment management account, you will be charged a quarterly account fee, as well as certain additional costs such as underlying investment fees and expenses and other miscellaneous fees. If you decide to implement sample recommendations in the proposal with another firm, you may be charged fees, commissions, or expenses by that firm, as well as underlying investment fees and expenses. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss. An investment in Exchange Traded Funds (ETF), structured as a mutual fund or unit investment trust, involves the risk of losing money and should be considered as part of an overall program, not a complete investment program.

An investment in ETFs involves additional risks such as non-diversification, price volatility, competitive industry pressure, international political and economic developments, possible trading halts, and index tracking errors. References to tax strategies that the GWP service investment management considers in managing accounts should not be confused with tax advice.

LPL Financial does not provide tax advice. Clients should consult with their personal tax advisors regarding the tax consequences of investing.

Contact Us

Fax: (720) 407-3012

Address: The Penthouse at

5670 Greenwood Plaza Blvd

Greenwood Village, CO 80111

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

The LPL Financial representatives associated with this website may discuss and/or transact securities business only with residents of the following states: AZ, CA, CO, FL, IN, KS, KY, MN, MO, NE, NM, OH, OR, TX, UT, WI.

** Asset and portfolio data through 9/30/18 for assets for which LPL Research has discretion.

Guided Wealth Portfolios (GWP) is a centrally managed, algorithm-based investment program sponsored by LPL Financial LLC (LPL). GWP uses proprietary, automated computer algorithms of FutureAdvisor to

generate investment recommendations based upon model portfolios constructed by LPL. FutureAdvisor and LPL are non-affiliated entities. If you are receiving advisory services in GWP from a separately registered

investment advisor firm other than LPL or FutureAdvisor, LPL and FutureAdvisor are not affiliates of such advisor. Both LPL and FutureAdvisor are investment advisors registered with the U.S. Securities and

Exchange Commission, and LPL is also a member of FINRA/SIPC.

There is no assurance that Guided Wealth Portfolios are suitable for all investors or will yield positive outcomes. The purchase of certain securities will be required to effect some of the strategies. Investing

involves risks including possible loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a nondiversified portfolio. Diversification and asset allocation do not protect against market risk.

References to tax strategies that the GWP service investment management considers in managing accounts should not be confused with tax advice. LPL Financial does not provide tax advice. Clients should

consult with their personal tax advisors regarding the tax consequences of investing.

Rebalancing a portfolio may cause investors to incur tax liabilities and does not assure a profit or protect against a loss.

A registered investment advisor.

Member FINRA/SIPC.

IIS-16541-

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC. The LPL Financial representatives associated with this website may discuss and/or transact securities business only with residents of the following states: AZ, CA, CO, FL, IN, KS, KY, MN, MO, NE, NM, OH, OR, TX, UT, WI.